Little Known Questions About Rating On Appliances.

Wiki Article

The Of Rating On Appliances

Table of ContentsRating On Appliances Can Be Fun For EveryoneHow Rating On Appliances can Save You Time, Stress, and Money.See This Report on Rating On AppliancesThings about Rating On Appliances

House insurance may likewise cover medical expenditures for injuries that individuals sustained by getting on your property. A property owner pays an annual costs to their house owner's insurer. Typically, this is someplace between $300-$1,000 a year, depending on the policy. When something is damaged by a catastrophe that is covered under the house insurance plan, a homeowner will certainly call their residence insurance policy business to sue.Property owners will generally have to pay an insurance deductible, a set quantity of cash that comes out of the home owner's wallet prior to the house insurance coverage firm pays any type of money in the direction of the insurance claim. A house insurance coverage deductible can be anywhere between $100 to $2,000. Usually, the greater the insurance deductible, the lower the yearly premium price.

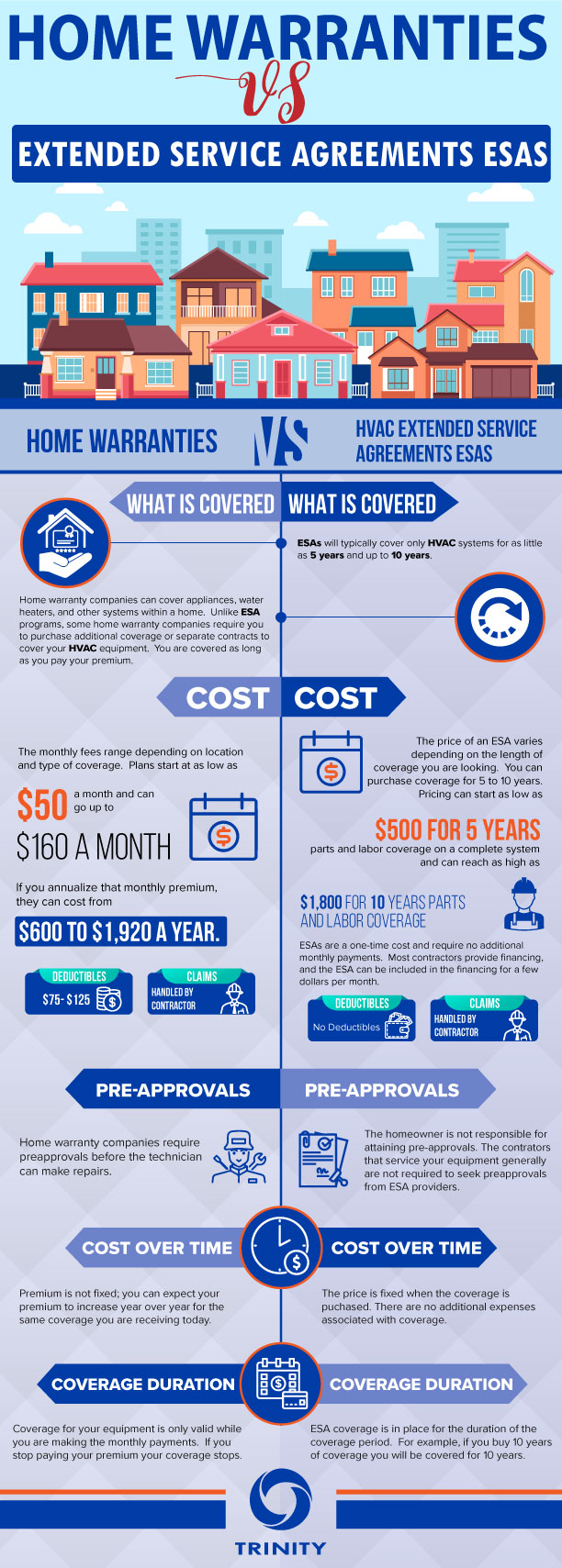

What is the Difference In Between House Service Warranty as well as House Insurance A house service warranty agreement as well as a residence insurance coverage operate in comparable ways. Both have an annual premium and a deductible, although a house insurance policy costs and insurance deductible is usually a lot greater than a residence guarantee's. The main distinctions between house service warranties and also home insurance policy are what they cover.

An additional distinction between a home warranty as well as home insurance is that house insurance is usually needed for property owners (if they have a home mortgage on their house) while a residence service warranty plan is not called for. A house guarantee and also residence insurance coverage supply defense on various parts of a residence, and also with each other they can safeguard a homeowner's budget from expensive repair work when they inevitably appear.

5 Easy Facts About Rating On Appliances Shown

If there is damages done to the framework of the residence, the owner won't have to pay the high costs to fix it if they have house insurance coverage. If the damages to the home's framework or home owner's possessions was produced by a malfunctioning appliances or systems, a residence warranty can help to cover the pricey repair services or replacement if the system or home appliance has actually failed from regular wear as well as tear - rating on appliances.They will certainly collaborate to supply defense on every component of your house. If you're interested in acquiring a residence service warranty for your house, have a look at Spots's house guarantee strategies and pricing here, or demand a quote for your home right here.

The difference is that a home service warranty covers a series of items as opposed to simply one. There are three standard sorts of home warranty plans. System prepares cover your house's mechanical systems, consisting of heating & cooling, electrical and plumbing. Home appliance strategies cover major devices, like check out here the dish washer, stove and also washing equipment.

Some Known Questions About Rating On Appliances.

Some products, like in-ground sprinklers, swimming pools and also septic systems, may require an additional service warranty or could not be covered by all residence service warranty business. When comparing house service warranty firms, see to it the plan choices include every little thing you would certainly want covered. rating on appliances.New building homes often come with a service warranty from the building contractor.Builder service warranties normally do not cover devices, though in a brand-new house with brand new devices, manufacturers' guarantees are likely still in play. If you're getting a home guarantee for a brand-new house either new construction or a residence that's brand-new to you protection typically starts when you close.

, your home guarantee firm may not cover it. Instead than depending exclusively on a guarantee, try to discuss with the seller to either fix the issue or provide you a credit history to aid cover the price of having it taken care of.

The Definitive Guide for Rating On Appliances

For one, house owners insurance is called for by lending institutions in order to acquire a home mortgage, while a house guarantee is entirely optional. As pointed out over, a residence service warranty covers the repair work and also replacement of things as well as systems in your residence.Your house owners insurance policy, on the other hand, covers the unexpected. It will not help you replace your devices due to the fact that they got old, but house owners insurance can help you get new home appliances if your existing ones are harmed in a fire or flood. With house owners insurance policy, you'll have to satisfy a insurance deductible before the insurer starts paying for the price of your claim.

Just how much does a house guarantee cost? Residence Continue warranties typically set you back between $300 and $600 per year; the cost will vary relying on the sort of plan you have. The extra that's covered, the pricier the plan those attachments can build up. Where you live can also influence the price.

Though you will not pay for the real repairs, you will certainly pay a solution cost every time a tradesperson involves your residence to examine an issue. If greater click reference than one pro is required, you can finish up paying a service charge even more than when for the same work. This charge can range from concerning $60 to $125 for each and every solution instance, making the service cost one more indicate consider if you're looking for a residence guarantee plan.

Report this wiki page